Wisconsin Tax Climate Update & Local Property Tax Levy Changes

Wisconsin State Journal Editorial:

The first step toward improving the state's tax climate must be for lawmakers to control spending. The state cannot afford to cut taxes and thus forgo revenue unless the next governor and Legislature do a better job of paring, consolidating and conserving.

Even the promise that lower taxes will generate more business development in the future will not address the immediate strains created by rising costs for Medicaid and other programs.

Tax Foundation's

report.

WISTAX has more:

- Municipal Property Taxes Outpace "Freeze", Rise 4.1% in Large Cities:

Despite a "freeze" designed to slow property tax growth, Wisconsin’s 230 largest cities and villages increased levies at the same rate as in prior years. According to the Wisconsin Taxpayers Alliance (WISTAX), municipal-purpose property tax levies rose 4.1% in these municipalities in 2005-06 (2006), the same as the average increase from 2002 to 2005.

- State Budget Increasingly on Autopilot:

In recent years, most state spending growth has been in two areas: school aids and Medical Assistance (MA). The inescapable link between state aid and school revenue limits on the one hand and property taxes on the other virtually assures that, when combined with accelerating MA costs, most new state revenue is already "spoken for." Funds for state agencies, higher education, and other state programs are likely to grow little, if at all, thus continuing a long trend..

State law gives the governor and legislators the power to enact budgets. Yet, through various actions and commitments from both over the past decade, they have increasingly put the state budget on autopilot.

- Election 2006 Issues and Questions.

The Milwaukee Journal-Sentinel:

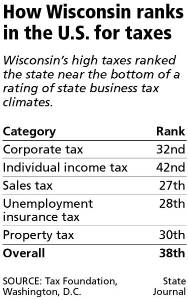

Globally, American companies already are at a disadvantage because the benchmark federal corporate tax rate is 35%, which the Tax Foundation notes is "one of the highest corporate tax rates of any of the industrialized economies" - even after the successive rounds of tax reductions under President Bush.

The foundation's report, however, only added to a bewildering array of national tax rankings, each using different methodologies that have sparked a lively debate among policy-makers.

The foundation's annual State Business Tax Climate Index is based on a weighted index that ranks each state's corporate taxes, individual income taxes, sales taxes, unemployment taxes and property taxes. While it relies on U.S. census data for each state's property tax, it compares state tax rates and tax laws to measure the other four. It employs a matrix of 10 subindexes and 113 variables.

The Madison-based Wisconsin Taxpayers Alliance, using the latest available census numbers, put Wisconsin at No. 6 when measured as a percentage of personal income. That figure represents years of incremental improvements after Wisconsin registered No. 3 in the nation under the same measures in 1994.

Taxes, particularly the much discussed property tax "Freeze" will certainly be on voter's minds

November 7, 2006. The Madison School District's 06/07 budget will grow local property taxes by 11,626,677 to $211,989,932 (5.8%) [See

2006/2007 Budget Executive Summary - PDF]. Gotta love politics, 5.8% is certainly not a freeze :). The Madison School District's property

tax levy changes over the past 6 years. The mill rate has not changed at the same rate as the levy increases because local assessed values have been increasing. That will probably change now as the housing market takes a breather.

Posted by Jim Zellmer at October 13, 2006 6:51 AM

Subscribe to this site via RSS/Atom:  Newsletter signup | Send us your ideas

Newsletter signup | Send us your ideas

| Newsletter signup | Send us your ideas

| Newsletter signup | Send us your ideas Newsletter signup | Send us your ideas

Newsletter signup | Send us your ideas