K-12 Tax & Spending Climate: New Jersey Governor Discusses Spending Growth Control

But there’s another line Christie likes to use to describe the fiscal situation he inherited: “The day of reckoning is here.” It’s difficult to argue his point. While nearly all states are in deep fiscal trouble, New Jersey is in deeper than most. Its deficit amounts to 37 percent of the entire state budget. Christie has responded by proposing to slash billions of dollars in state spending on everything from aid to municipalities to the normally sacrosanct K-12 education system. More than 1,300 state government positions would be eliminated.

The governor’s proposal — and his unapologetic defense of it — have made him a villain to mayors, teachers, superintendents and other public employees. But Christie, perhaps more than any other governor these days, has captured the imagination of conservatives who admire his eagerness to take on powerful public employee unions. Many Republicans believe that Christie’s tough stance on spending is hitting exactly the right political note in a major election year marked by anti-government anger and Tea Party activism.

Indeed, with the governorships of 37 states up for grabs in November — and state finances not expected to improve much anytime soon — Christie’s budget-cutting quest and all the hot rhetoric both for and against it may amount to much more than political theater. It may be a preview of how some new Republican governors will lead in states they win this year. In Pennsylvania, Attorney General Tom Corbett, the front-runner to become the GOP’s candidate for governor, says he’s been paying close attention to what’s going on in the state next door. Chris Christie, he told Stateline in an interview, “has made a very good example.”It is difficult to see growth in redistributed state and federal tax dollars for K-12 organizations over the next few years.

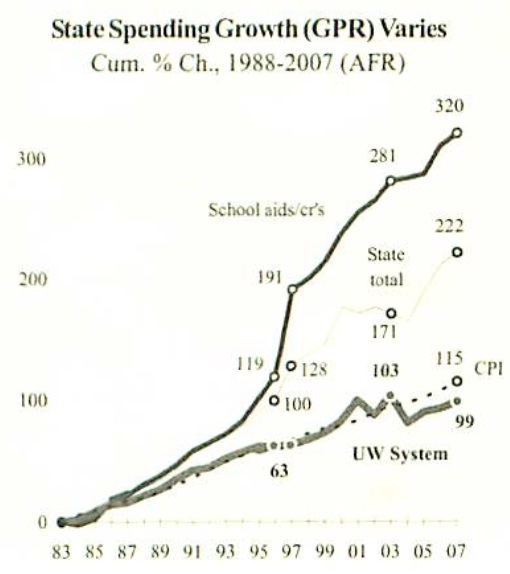

State of Wisconsin K-12 redistributed tax dollars have grown substantially over the past 25+ years, as this chart illustrates.

Redistributed state tax dollars are generated from personal & corporate income taxes and fees.

The Economist has more on New Jersey:I watched him campaign last year. His message was simple: he vowed to cut spending and red tape. He also stressed that he was not Jon Corzine, the unpopular Democratic governor. Mr Corzine, for his part, emphasised that Mr Christie was a) a Republican and b) fat. The first argument alone would usually be enough to win an election in New Jersey. But last year was a bad time to be a) an incumbent or b) a former boss of Goldman Sachs, and Gov. Corzine was both.

I wondered at the time if Mr Christie meant what he said about doing painful things to rescue New Jersey from its deep pit of debt. It seems that he did. In no time at all, he plugged a short-term budget gap by slashing spending. He has also set his sights on the outlandish benefits enjoyed by some public-sector workers, citing as an example a 49 year old retiree who paid $124,000 towards his retirement benefits and expects to get back $3.8m.

He proposed to balance the budget for fiscal 2011 by cutting a third from projected outlays. He suggested that teachers’ pay be frozen, rather than raised by 4-5%, and that they contribute a small amount (1.5% of salary) towards their health benefits.