Wisconsin Education Superintendent Seeks 2-4% annual increases in redistributed state tax dollars, introduction of a poverty formula and a shift in Property Tax Credits

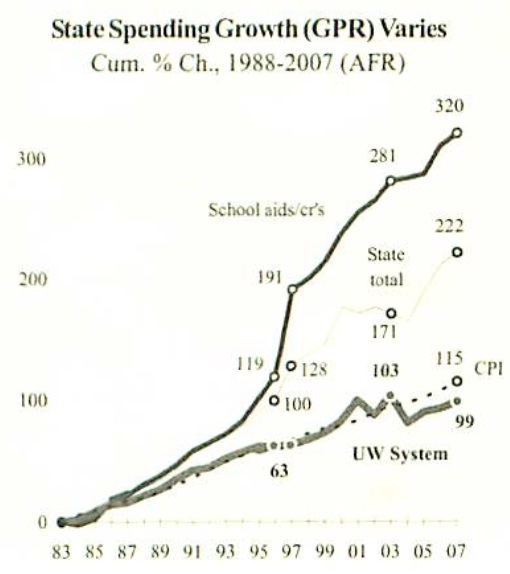

Many links as the school finance jockeying begins, prior to Governor Scott Walker’s January, 2011 inauguration. Wisconsin’s $3,000,000,000 deficit (and top 10 debt position) makes it unlikely that the K-12 world will see any funding growth.

Matthew DeFourEvers plan relies on a 2 percent increase in school aid funding next year and a 4 percent increase the following year, a tough sell given the state’s $3 billion deficit and the takeover of state government by Republicans, who have pledged budget cuts.

One major change calls for the transfer of about $900 million in property tax credits to general aid, which Evers said would make the system more transparent while having a negligible impact on property taxes. That’s because the state imposes a limit on how much a district can raise its total revenue. An increase in state aid revenue would in most cases be offset by a decrease in the other primary revenue — property taxes.

Thus the switch would mean school districts wouldn’t have such large annual property tax increases compared to counties, cities and other municipalities, even though tax bills would remain virtually the same, said Todd Berry, executive director of the Wisconsin Taxpayers Alliance.

“Distributing the money through the school aid formula, from a pure policy sense, is probably more equitable than distributing it in its current tax credit form,” Berry said. “The money will tend to help districts that tend to be poorer or middle-of-the-road.”Inequities in the current system tend to punish public schools in areas like Madison and Wisconsin’s northern lake districts because they have high property values combined with high poverty and special needs in their school populations. The current system doesn’t account for differences in kids’ needs when it doles out state aid.

Education policy makers as well as politicians on both sides of the aisle have talked school funding reform for over a dozen years but it’s been a tough sell because most plans have created a system of winners and losers, pitting legislator against legislator, district against district.

Evers’ plan, which calls for a 2 percent increase in school aid funding next year and a 4 percent increase the following year, as well as a transfer of about $900 million in property tax credits to general aid, addresses that issue of winners and losers. Over 90 percent of districts are receiving more funding under his proposal. But there aren’t any district losers in Evers’ plan, either, thanks to a provision that requests a tenth of a percent of the total state K-12 schools budget — $7 million — to apply to districts facing a revenue decline.Wisconsin State and Local Debt Rose Faster Than Federal Debt During 1990-2009 Average Annual Increase in State Debt, 7.8%; Local Debt, 7.3%

Rewrite of Wisconsin school aid formula has cost

Wisconsin Department of Public Instruction:

The following printout provides school district level information related to the impact of State Superintendent Evers’ Fair Funding proposal.

Specifically, the attachment to this document shows what each school district is receiving from the state for the following programs: (1) 2010-11 Certified General Aid; (2) 2009-10 School Levy Tax Credit; and (3) 2010-11 High Poverty Aid.

This information is compared to the potential impact of the State Superintendent’s Fair Funding proposal, which is proposed to be effective in 2012-13, as if it had applied to 2010-11.

Specifically, the Fair Funding Proposal contains the following provisions:But the plan also asks for $420 million more over the next two years – a 2% increase in funding from the state for the 2011-’12 school year and 4% more for the following year – making it a tough sell in the Legislature.

State Sen. Alberta Darling (R-River Hills), who will co-chair the powerful Joint Finance Committee, said she considered the proposal pretty much dead on arrival in the state Legislature, which will be under Republican control next year, without further changes.

“I think those goals are very admirable,” said Darling, who has been briefed on the plan. “But, you know, it’s a $6 billion budget just for education alone and we don’t have the new money. I think we have to do better with less. That’s just where we are.”

On Friday, Governor-elect Scott Walker said his office had only recently received the proposal from the DPI and he had not had time to delve into its details or to speak with Evers. He said he hoped to use his budget to introduce proposals that would help school districts to control their costs, such as freeing them from state mandates and allowing school boards to switch their employees to the state health plan.