July, 2013 Madison Schools 2013-2014 Budget Presentation (PDF). Notes:

- No mention of total spending…. How might the Board exercise its oversight obligation without the entire picture?

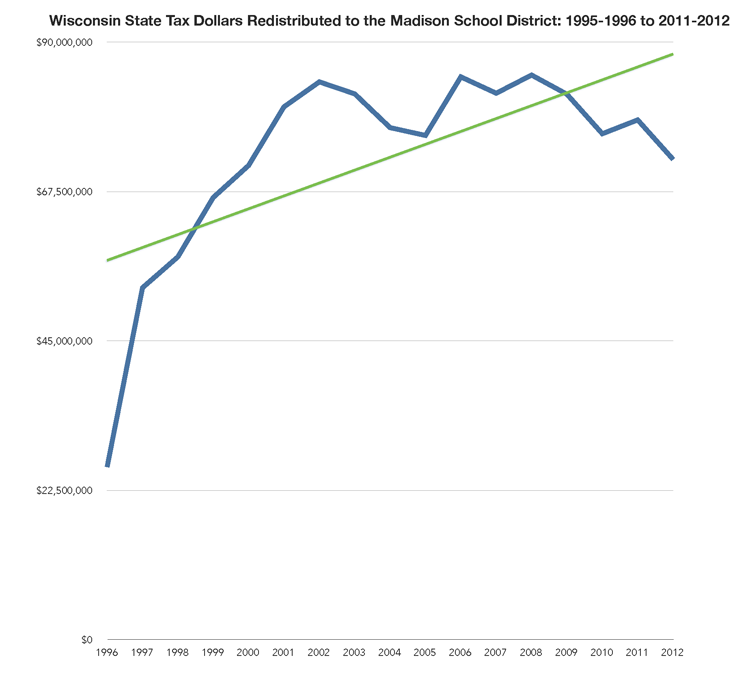

- The substantial increase in redistributed state tax dollars (due to 4K) last year is not mentioned. Rather, a bit of rhetoric: “The 2013-14 budget development process has focused on actions which begin to align MMSD resources with the Strategic Framework Priorities and strategies to manage the tax levy in light of a significant loss of state aid.” In fact, according to page 6, the District expects to receive $46,392,012 in redistributed state tax dollars, which is a six (6%) increase over the funds received two years ago.

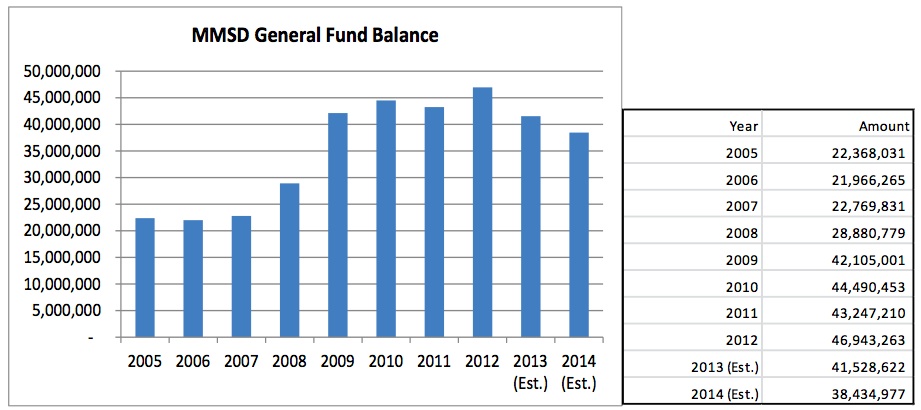

- The District’s fund equity (financial cushion, or reserves) has more than doubled in the past eight years, from $22,368,031 in 2005 to $46,943,263 in 2012.

- Outbound open enrollment continues to grow, up 14% to 1,041 leavers in 2013 (281 inbound from other Districts).

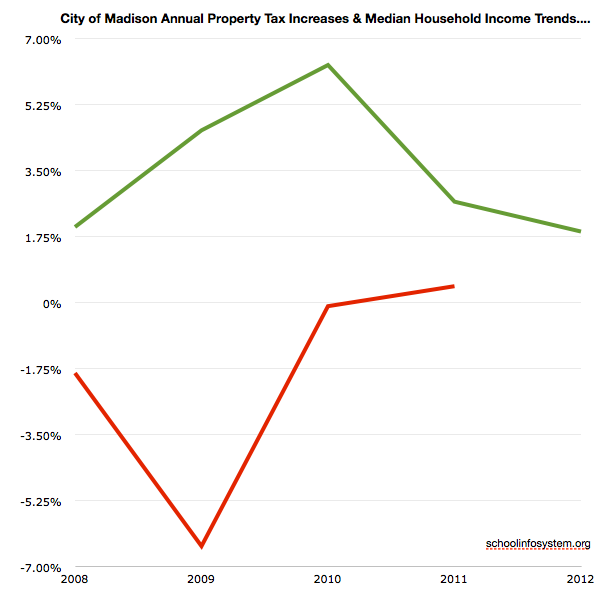

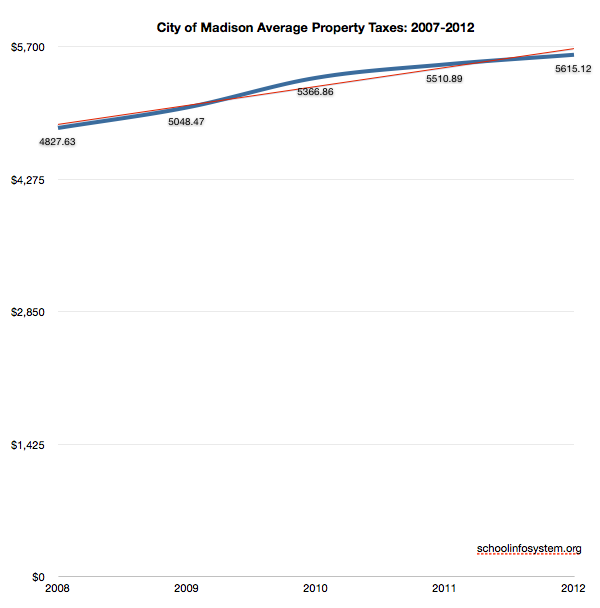

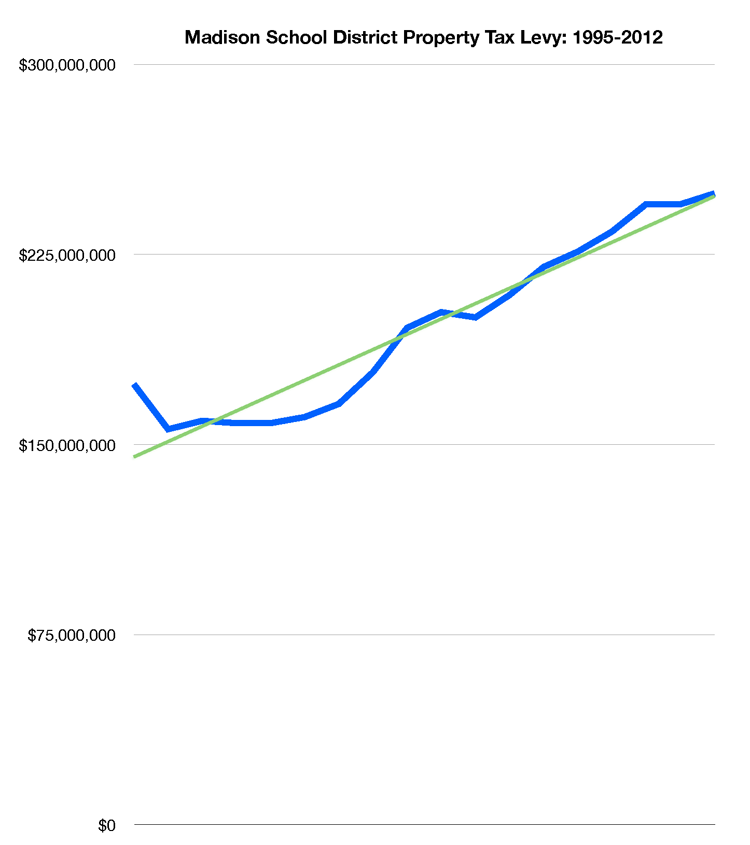

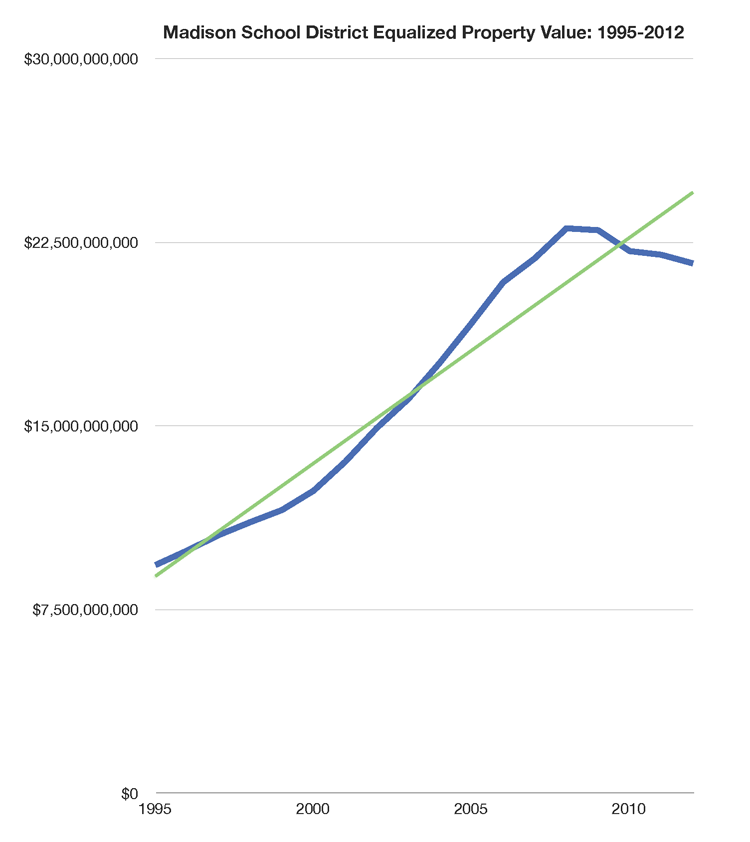

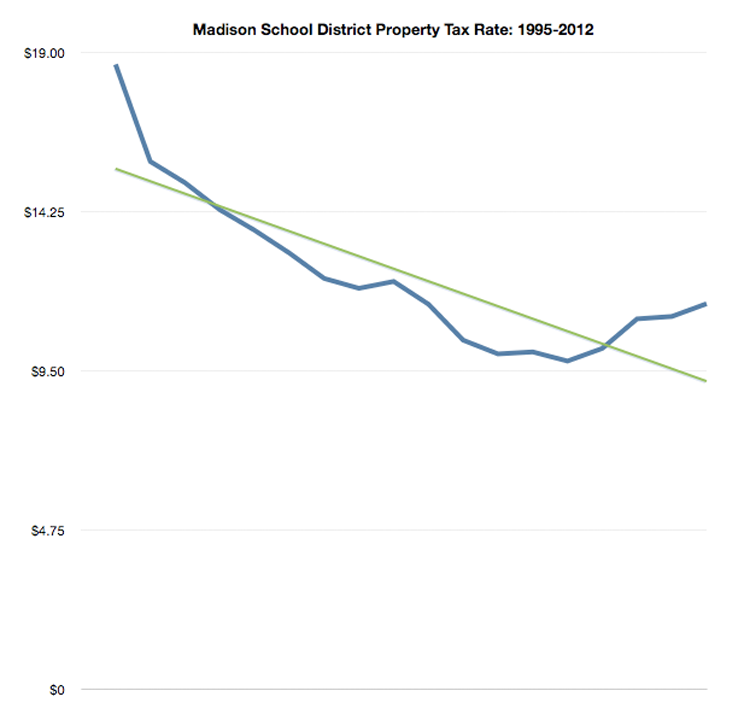

- There is no mention of the local tax or economic base:

- The growth in Fund 80 (MSCR) property taxes and spending has been controversial over the years. Fund 80, up until recently was NOT subject to state imposed property tax growth limitations.

- Matthew DeFour briefly summarizes the partial budget information here. DeFour mentions (no source referenced or linked – in 2013?) that the total 2013-2014 budget will be $391,000,000. I don’t believe it:

The January, 2012 budget document mentioned “District spending remains largely flat at $369,394,753” (2012-2013), yet the “baseline” for 2013-2014 mentions planned spending of $392,807,993 “a decrease of $70,235 or (0.02%) less than the 2012-13 Revised Budget” (around $15k/student). The District’s budget generally increases throughout the school year, growing 6.3% from January, 2012 to April, 2013. Follow the District’s budget changes for the past year, here.

Finally, the document includes this brief paragraph:

Work will begin on the 2014-15 early this fall. The process will be zero-based, and every line item and FTE will be carefully reviewed to ensure that resources are being used efficiently. The budget development process will also include a review of benefit programs and procurement practices, among other areas.

One hopes that programs will indeed be reviewed and efforts focused on the most urgent issues, particularly the District’s disastrous reading scores.

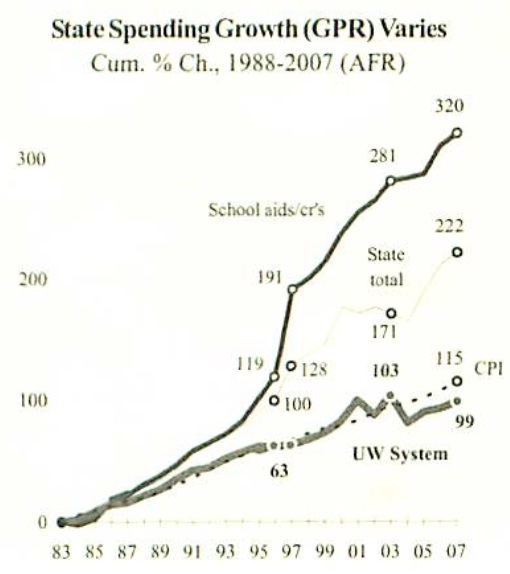

Ironically, the recent “expert review” found that Analysis: Madison School District has resources to close achievement gap. If this is the case (and I agree with their conclusion – making changes will be extraordinarily difficult), what are students, taxpayers and citizens getting for the annual tax & spending growth?

I took a quick look at property taxes in Middleton and Madison on a $230,000 home. A Middleton home paid $4,648.16 in 2012 while a Madison home paid 16% more, or $5,408.38.

I added this comment to Mr. DeFour’s brief summary:

There’s quite a bit more behind the proposed tax & spending growth that Mr. DeFour’s article fails to include:

http://www.schoolinfosystem.org/archives/2013/07/45_increase_in_.php

A few examples:

1. Fund 80 (MSCR) property taxes increased 45% last year (!) Fund 80 spending growth has been an issue in the past.

2. Redistributed state tax dollars are 6% greater than two years ago. Last year’s significant increase in state taxpayer money was a one time event due to the District’s 4K launch. Neither the District, nor Mr. DeFour mention this fact.

3. The District’s source document does not mention total spending. Mr. DeFour does not link to it (you’ll find it in the link included above). The District’s total spending typically increases throughout the year.

http://www.schoolinfosystem.org/archives/2013/04/status_quo_cost.php

4. The recent “expert review” stated that the “Madison School District has resources to close achievement gap”.

http://www.schoolinfosystem.org/archives/2013/06/analysis_madiso.php

5. Mr. DeFour and the District fail to mention Madison’s tax base or recent per capita income trends.