Latest Madison Schools’ 2013-2014 $391,834,829 Budget

The Board of Education must adopt a tax levy by November 6, 2013. We recommend a total tax levy for all Funds of $257,727,292. This is a 3.38% increase over the prior year, and a 1.09% decrease over the levy estimate included in the August 2013 preliminary budget. The Board’s ‘unused’ levy authority, which can be preserved and carried forward, is $8.9 million.

We also recommend that the Board adopt a Fall Budget for 2013-14 which will replace the preliminary budget approved in August. The Fall Budget has been updated to reflect the latest information regarding funding, grants, and actual staffing levels. A review of all budget line items was included in the update process, with adjustments made wherever necessary to improve the accuracy of the budget.

The materials included in this packet provide multiple layers of detail concerning the budget and tax levy, from the concise ‘DP! recommended budget format’ to more detailed views of the budget and levy.The current 2013-2014 budget spends $391,834,829 for 27,186 pk-12 students or $14,413/student. Note that per student spending is not linear for pre-k plus full time students.

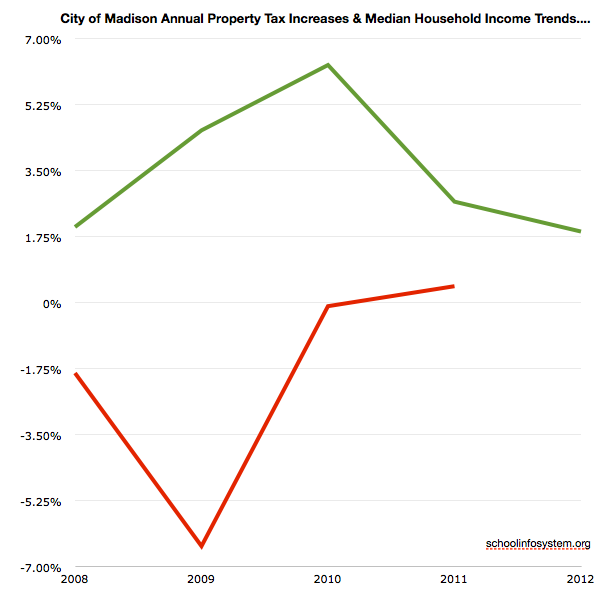

Related: Madison’s Planned $pending & Property Tax Increase: Does it Include $75/Student “Unrestricted” State Budget Increase (Outside of Revenue Caps)?, 45% (!) Increase in Madison Schools’ Fund 80 Property Taxes from the 2011-2012 to 2012-2013 School Year; No Mention of Total Spending, Madison Schools’ 2013-2014 Budget Charts, Documents, Links, Background & Missing Numbers and Madison’s disastrous reading results.