Proposed Question 1:

Shall the Madison Metropolitan School District, Dane County, Wisconsin be authorized to exceed the revenue limit specified in Section 121.91, Wisconsin Statutes, by $6,000,000 for 2020-2021 school year; by an additional $8,000,000 (for a total $14,000,000) for 2021-2022 school year; by an additional $9,000,000 (for a total of $23,000,000) for the 2022-23 school year; and by an additional $10,000,000 (for a total of $33,000,000) for the 2023-2024 school year and thereafter, for recurring purposes consisting of operational and maintenance expenses?

“Unknown revenues from the state…

Now more than ever public education funding is at risk and local control will matter.”Question 2:

Shall the Madison Metropolitan School District, Dane County, Wisconsin be authorized to issue pursuant to Chapter 67 of the Wisconsin Statutes, general obligation bonds in an amount not to exceed $317,000,000 for the public purpose of paying the cost of a school building and facility improvement project consisting of: renovations and additions at all four high schools, including safety and security improvements, plumbing/heating and cooling, science labs and classrooms, athletic, theatre, and environmental sustainability improvements; land acquisition for and construction of a new elementary school located near Rimrock Road to relocate an existing elementary school; remodeling the district owned Hoyt School to relocate Capital High; and acquisition of furnishings fixtures and equipment?

The presentation deck failed to include:

1. Total tax & spending changes over time.

From a kind reader, posted at mmsdbudget:

MMSD Budget Facts: from 2014-15 to 2020-21 [July, 2020]

Property taxes up 37% from 2012 – 2021.

1. 4K-12 enrollment: -1.6% (decrease) from 2014-15 to projected 2020-212. Total district staffing FTE: -2.9% (decrease) from 2014-15 to proposed 2020-21

3. Total expenditures (excluding construction fund): +15.9% +17.0% (increase) from 2014-15 to proposed 2020-21

4. Total expenditures per pupil: +17.8% +19.0%(increase) from 2014-15 to proposed 2020-21

5. CPI change: +10.0% (increase) from January 2014 to January 2020

6. Bond rating (Moody’s): two downgrades (from Aaa to Aa2) from 2014 to 2020

Sources:

1. DPI WISEdash for 2014-15 enrollment; district budget book for projected 2020-21 enrollment

2. & 3.: District budget books

5. Bureau of Labor Statistics (https://www.bls.gov/data/)

6. Moody’s (https://www.moodys.com/)

– via a kind reader (July 9, 2020 update).

2. A comparison of Madison’s maintenance spending vs other taxpayer supported school districts.

“Madison spends just 1% of its budget on maintenance while Milwaukee, with far more students, spends 2%” – Madison’s CFO at a fall 2019 referendum presentation.

3. Enrollment forecasts.

4. Achievement and spending information; “bang for the buck”.

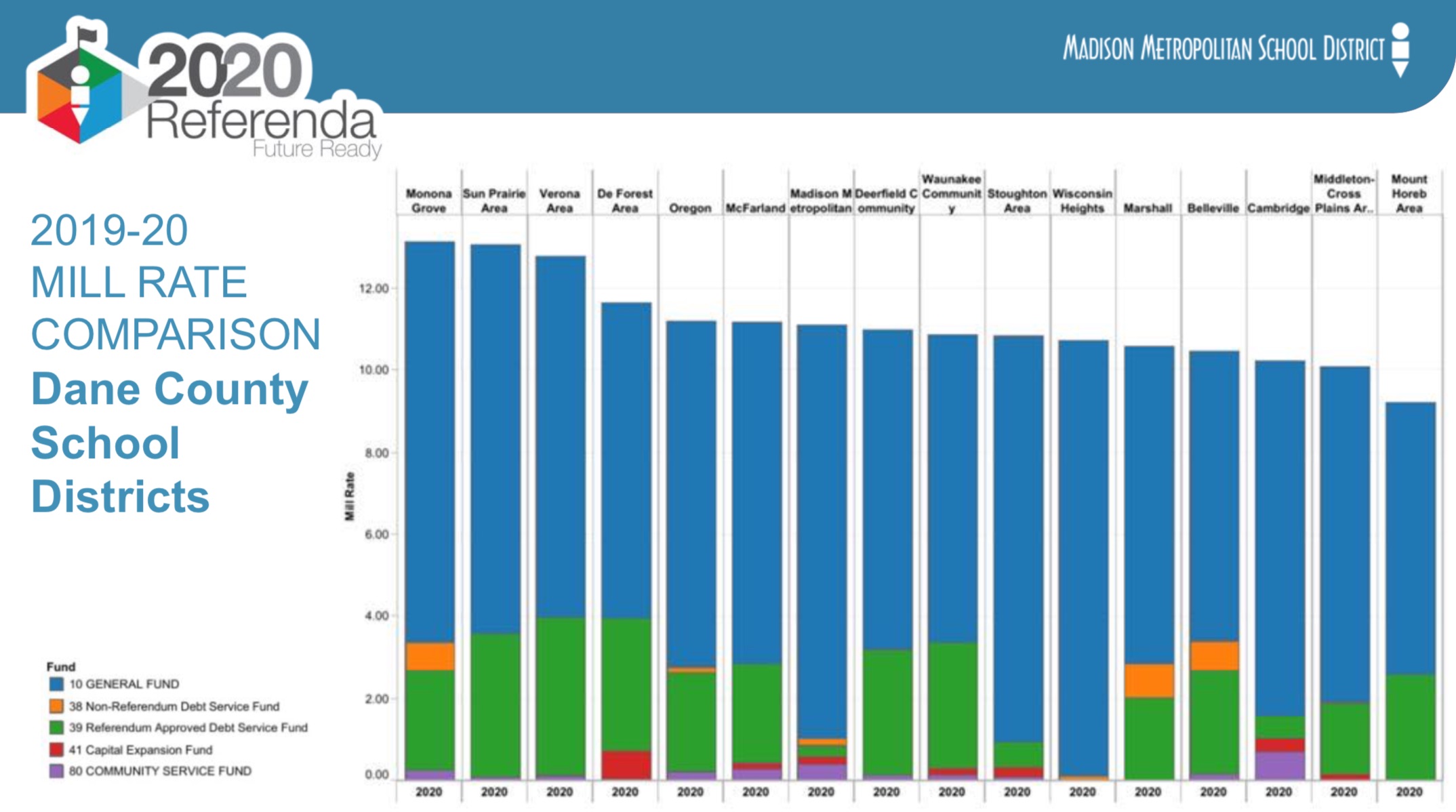

5. Substantive property tax burden between school districts. The included mill rate comparison is one part of the equation.

Changes in assessed value, redistributed state and federal taxpayer fund changes and spending growth data have gone missing.

2017: West High Reading Interventionist Teacher’s Remarks to the School Board on Madison’s Disastrous Reading Results

Madison’s taxpayer supported K-12 school district, despite spending far more than most, has long tolerated disastrous reading results.

My Question to Wisconsin Governor Tony Evers on Teacher Mulligans and our Disastrous Reading Results

“An emphasis on adult employment”

Wisconsin Public Policy Forum Madison School District Report[PDF]

Booked, but can’t read (Madison): functional literacy, National citizenship and the new face of Dred Scott in the age of mass incarceration